Retirement, Reinvented.

Own Your Future.

Why FinPath 403(b)?

Crystal-Clear Pricing

High-Performing Investments

We don’t chase trends. We offer what works. Our fund lineup includes top-ranked options with consistent double-digit returns over time.

Fiduciary First. Always.

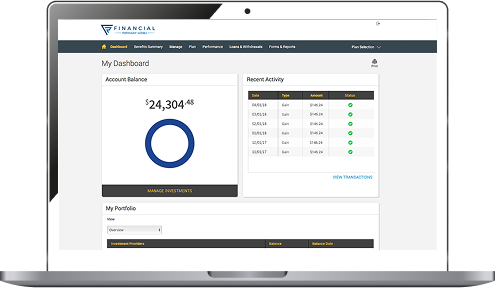

24/7 Access, 0% Stress

Why a 403(b) Account?

Your contributions are made before taxes—meaning you lower your taxable income now while building serious wealth for later.

Money goes in automatically from your paycheck. No logins, no decisions, no excuses. You’re saving in the background while you live your life.

Because your dollars go in pre-tax and stay invested, they have more room to grow—faster, smarter, and stronger.

Your state pension likely won’t cut it on its own. A 403(b) helps close the gap between “barely getting by” and “living on your terms.”

How to Enroll

Step 1: Click Enroll Now button

You’ll be taken to our secure enrollment portal to begin.

Step 2: Enter your employer’s name

Then select the correct 403(b) Admin Plan tied to your organization.

Step 3: Follow the steps until completion

Just follow the guided prompts—when you see the confirmation, you’re officially in.

Note: You can log in anytime to manage contributions or monitor your progress.

Prefer to Watch Instead?

FAQs

Still got questions? We’ve got answers.

What is a 403(b) plan, exactly?

Can I change how much I contribute?

How much should I contribute?

What happens if I change jobs?

Are there fees?

How do I enroll?

Click any Enroll Now button on the site to get started. Then:

- Enter your employer’s name and select your 403(b) Admin Plan.

- Follow the steps on screen until you see the completion notice.

- That’s it—you’re enrolled! You can log in anytime to adjust your contributions or track your growth.

Need a walkthrough? Watch the quick video →

Contact Us

900 S Capital of Texas Hwy

Suite 350

Austin, TX 78746

Customer Service: (800) 943-9179

Fax: (888) 989-9247

Business Hours: Monday through Friday, 8AM - 7PM CST

Important Disclosures

Investment advisory services offered through TCG Advisors, an SEC registered investment advisor. Insurance Services offered through HUB International. Recordkeeper and Third Party Administrator services offered through TCG Administrators, a HUB International Company.

HUB International, owns and operates several other entities which provide various services to employers and individuals across the U.S.

This website is not authorized for use as an offer of sale or a solicitation of an offer to purchase investments. This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, or as an offer to provide advisory or other services in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction.

Past performance may not be indicative of any future results. No current or prospective client should assume that the future performance of any investment or investment strategy referenced directly or indirectly in this brochure will perform in the same manner in the future. Different types of investments and investment strategies involve varying degrees of risk—all investing involves risk—and may experience positive or negative growth. Nothing in this brochure should be construed as guaranteeing any investment performance.

This website may contain forward-looking statements and projections that are based on our current beliefs and assumptions on information currently available that we believe to be reasonable; however, such statements necessarily involve risks, uncertainties, and assumptions, and prospective investors may not put undue reliance on any of these statements.